Individual Investors

Moving Forward Together

Thank You to Our Investors

People helping people is core to who we are as a company, and our Notes investors have helped millions of borrowers get on the path to financial health. Investors like you are the heartbeat of the LendingClub platform, and we appreciate each of our investors and value the trust you’ve placed with us over the years.

While we close one chapter, we’re opening another

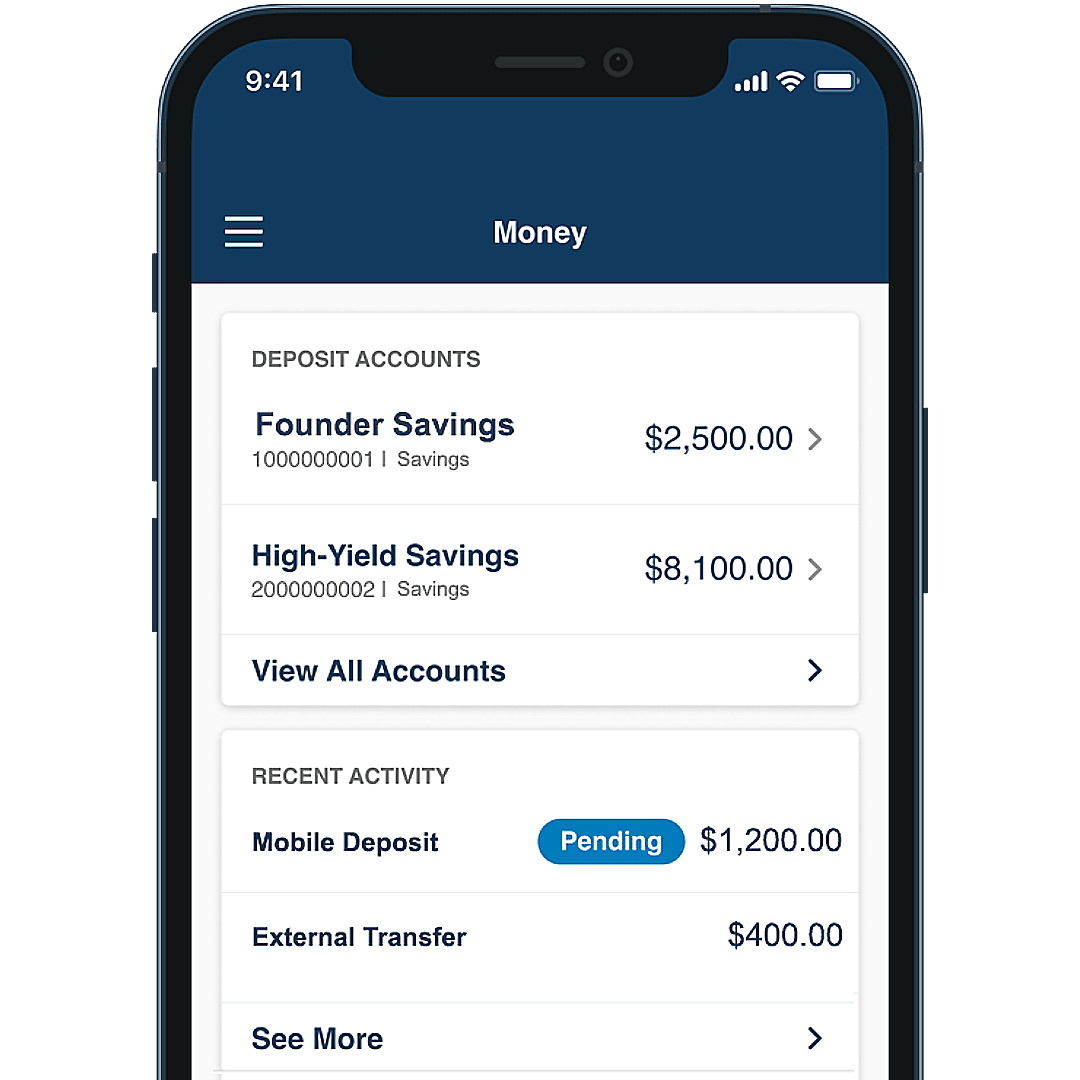

Though Notes are no longer available for investment, we are pursuing new banking capabilities as part of our acquisition of Radius Bank that will enable us to offer even more to our investors in the future. We’re hard at work developing new products to help our members keep more of what they earn and earn more on what they keep. Our very first offering—a high yield savings account—is just for you, our valued Notes investors.

An Exclusive High-Yield Savings Account for Our Founding Members

The Founder Savings account will pay a market-leading 5.05% APY1 and will only be offered to you, our Notes investors, as a sincere thank you for your dedication to the LendingClub platform. Deposits will be FDIC insured up to $250,000.

Unfortunately, Notes are no longer available for investment. Check back soon on new products LendingClub will offer to individual investors.

Your existing Notes are not impacted, and servicing of your investment account will continue per usual, until all Notes in your account fully mature.

No, the secondary market for trading (buying or selling) Notes is no longer available.

We’re here to help. You can visit our Help Center or contact us for more information at investing@lendingclub.com