AUTO LOAN REFINANCING

Members save more than $2,200 on average by refinancing their auto loan1

Auto Loan Refinancing

Paying off your existing car loan and refinancing into a new one could help you save money by scoring a lower interest rate. If you’re still using dealer financing, rates have likely dropped since you got your existing loan. So, if you’ve been keeping up with your payments, now

could be a great time to check your rate and save.

Drive away with better terms

Check your rate in minutes

Lower Your Monthly Payment

Easy, Simple, Secure

How Auto Refinancing Works with LendingClub

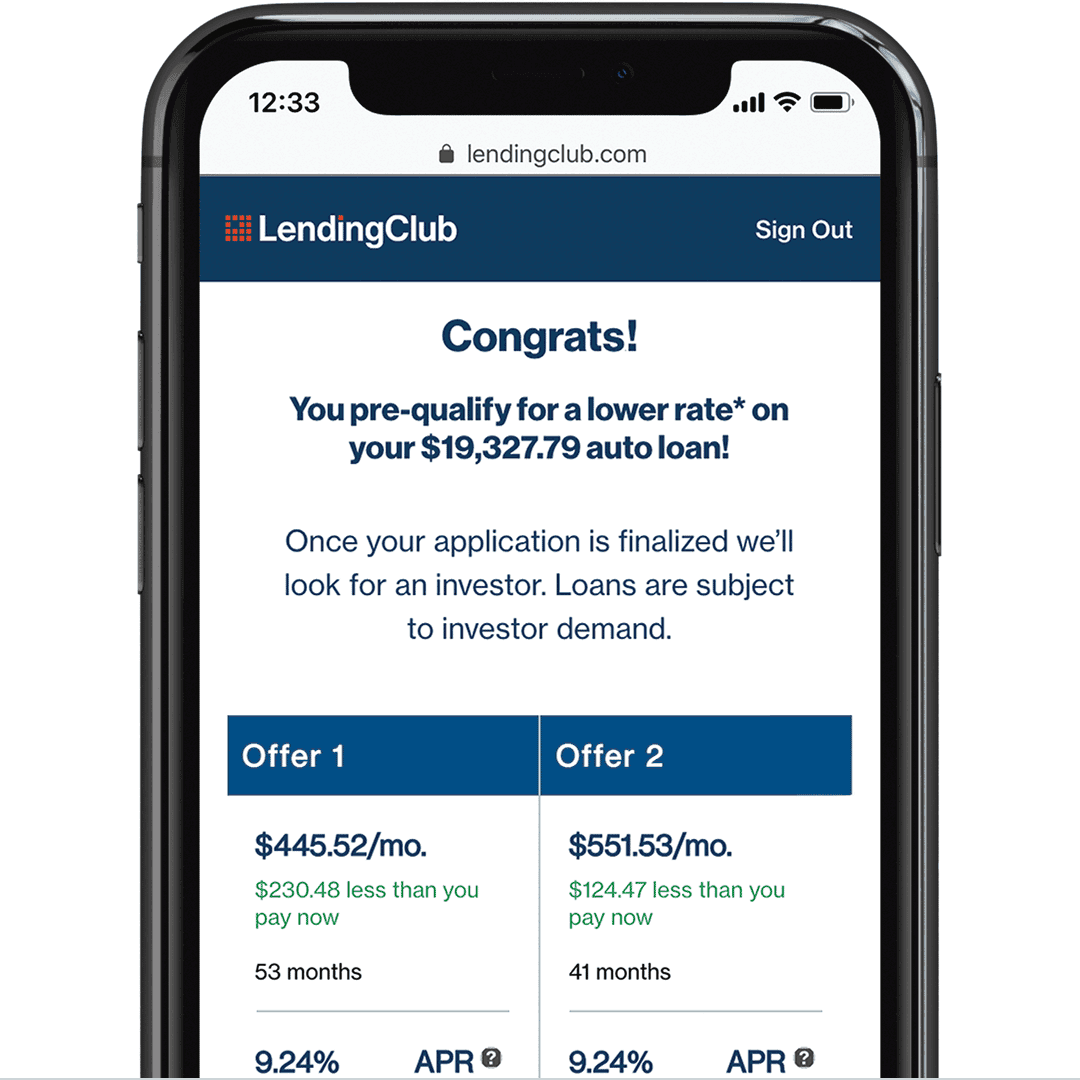

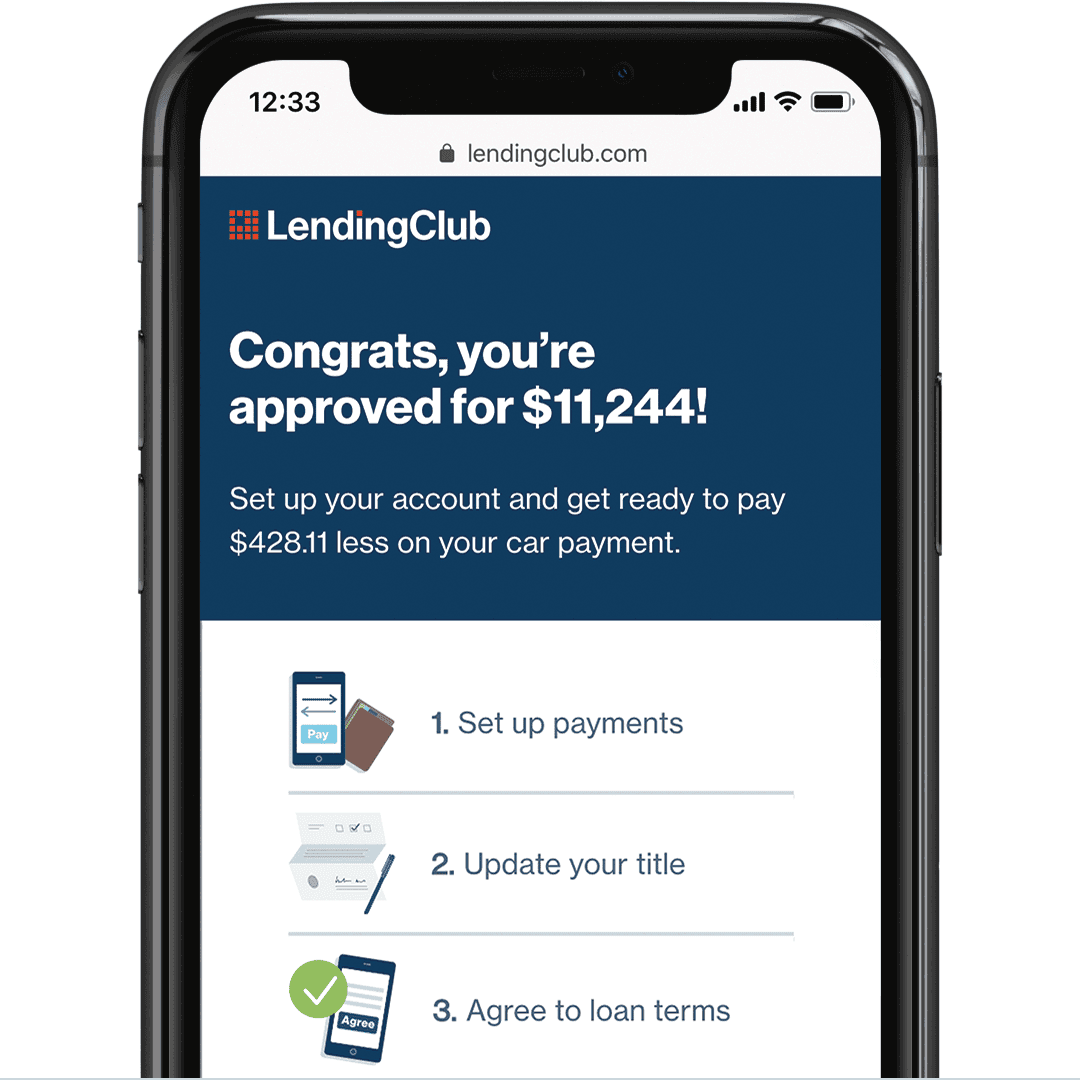

Auto refinancing is when you pay off your existing car loan and replace it with a new one, usually from a different lender. Refinancing your auto loan could help you save money by securing a lower interest rate. Or you can reduce your monthly payments by adjusting the length of your loan term, freeing up cash for other financial needs.

To qualify for auto loan refinancing through LendingClub, your vehicle must be for personal use, loans are generally available for vehicles that are 10 years old or newer (based on vehicle model year) and have 120,000 miles or fewer. In some cases, the most well-qualified borrowers will be eligible with vehicles having up to 150,000 miles and vehicles that are up to 13 years old.

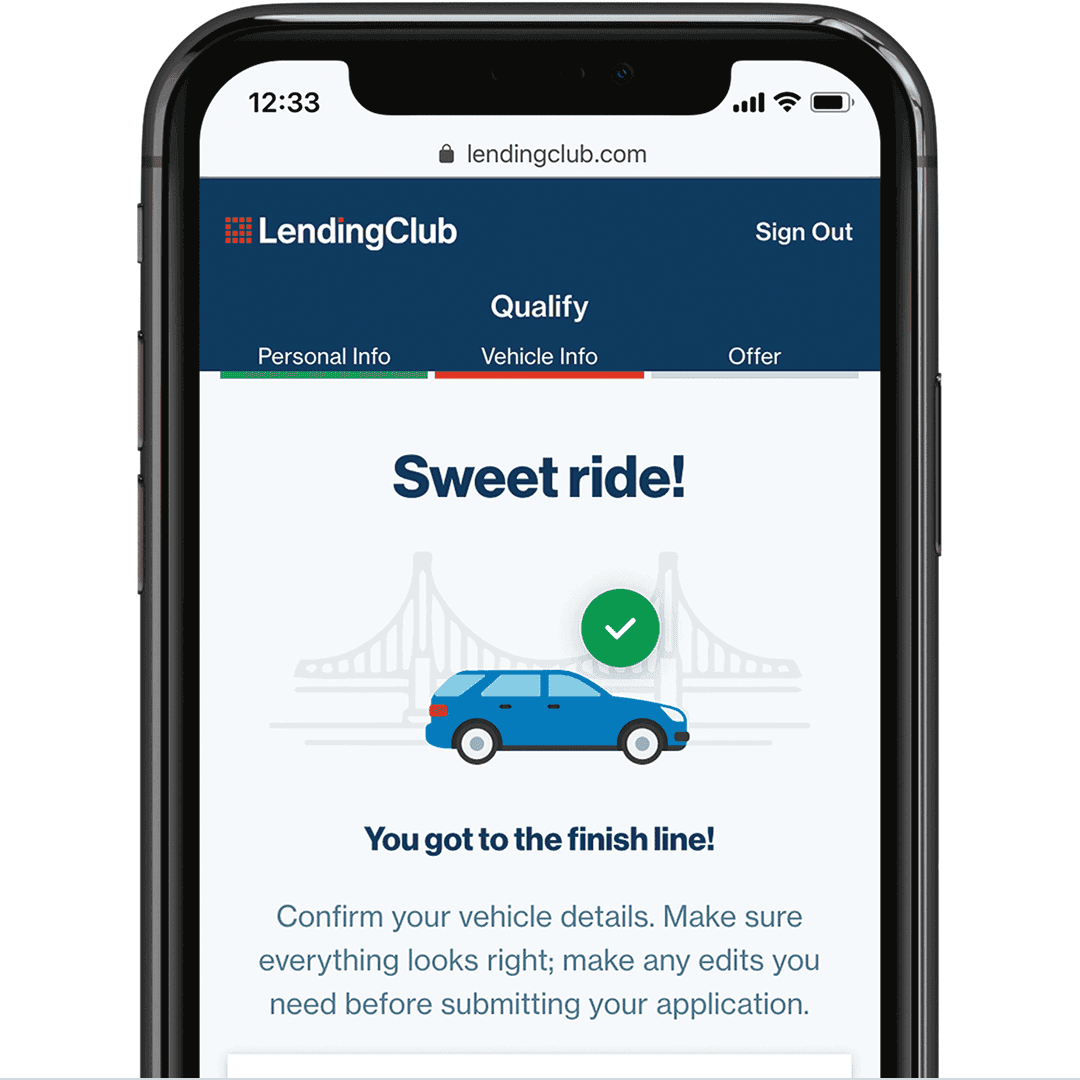

Applying online is simple, takes only a few minutes, and you can do it all on your phone tablet or laptop from the comfort of your home. If you qualify, you'll receive your offers almost immediately.

During the application process, we’ll ask about your driver’s license, vehicle registration, and proof of insurance. We may also ask you to send us additional documentation to confirm your income or other information, if necessary.

Don’t worry, you can easily snap a photo and upload it right from your phone.

You can check your rate through LendingClub as many times as you like, with no impact to your credit score. No one except you can see the soft credit inquiries on your credit report. However, once you accept an offer and your new auto loan has been funded, we will do a hard credit check which will post to your credit report, indicating that you have accessed credit from LendingClub Bank. This may or may not impact your credit score in the short term.

Refinancing your existing auto loan can reduce your interest rate or lower your monthly payment. Members save more than $2,200 on average by refinancing their auto loan1