BUSINESS BANKING

Digital Invoicing

Send a professional invoice right to your customer’s inbox

Easily request, accept and track payments digitally for your business

Send secure invoices

Create and send great-looking invoices straight to your customers’ inboxes within minutes. Delight your customers with easy online payment options, allowing them to instantly make payments using their debit card, credit card, or an electronic bank transfer.

Payments go right into your business checking account

In just a few clicks, your customers pay you and the funds are directly deposited into your Tailored Checking account. There is no waiting period, which means you can get your money as early as the next day.

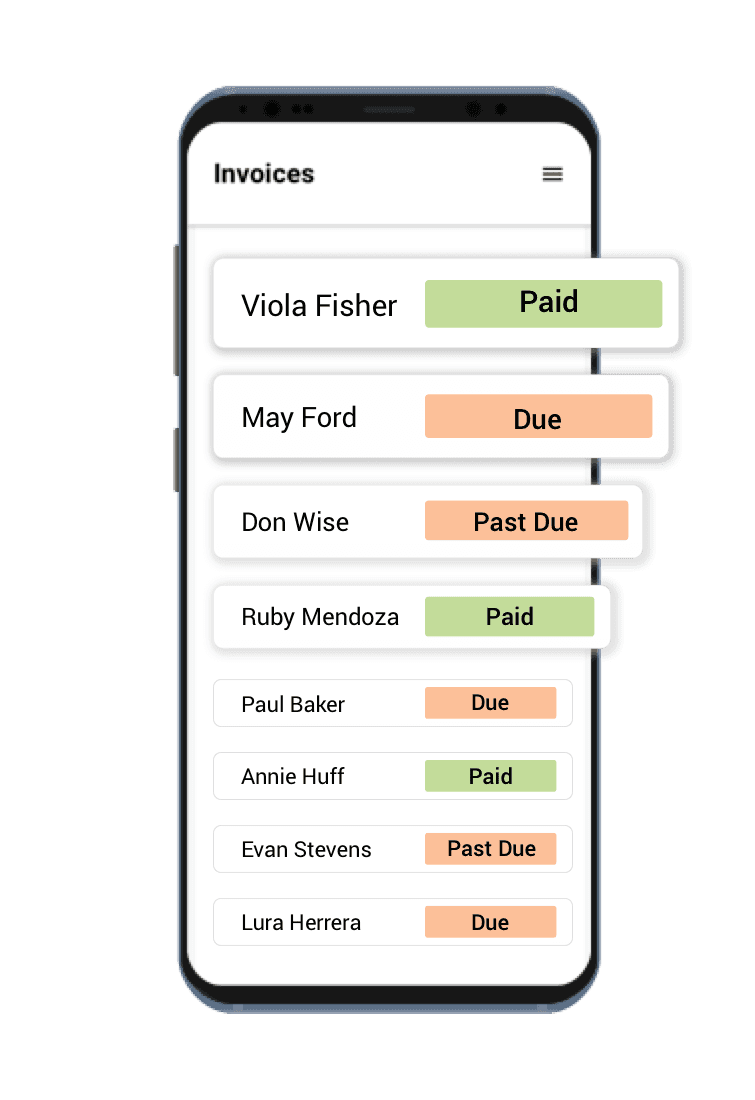

Track your payment activity

Quickly see who opened your invoices, who made a payment and who still owes you money. With Autobooks, you’ll also have access to detailed reports such as Balance Sheets or General Ledgers.

This invoicing and payment technology is already included as part of your business checking account!

Give Autobooks a try by clicking on the Create an Invoice link found underneath the Tools tab in the main menu of your online banking.

Digital banking, made human

Security

FDIC insurance

Customer Support