Need to change the bank account you linked when you applied? You can make that change directly from your Account Summary. When you change your account, we’ll send you an email confirmation and ask that you verify the new bank account.

Linking your new bank account

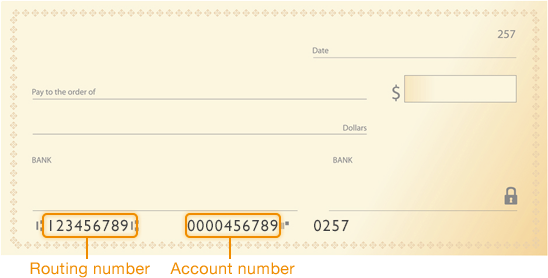

Before you begin, make sure you have the routing number and account number of your new bank account, then follow these steps:

Go to your Account Summary and click the Bank Account link in the top navigation bar.

Click Change Account.

Enter your new bank account information, including the following:

Bank name

Routing number

Account number

4.Click Submit.

Note: Credit unions sometimes use a different account number for automatic transactions like ACH payments. If you have a credit union account, confirm that you have the account number for ACH deposits and withdrawals.

Verifying your new bank account

Once you link your new bank account, we’ll deposit and withdraw the same small amount (less than one dollar) from that account to confirm that we can both send and retrieve money. It will post to your bank account within four business days. Once it does, you’ll need to verify your account by following these steps:

Note the amount that we deposited into and withdrew from your new bank account.

Go to your Account Summary and click the Bank Account link in the top navigation bar.

Click Verify Account.

Enter the amount that we deposited into and withdrew from your new bank account in the Debit Amount field.

Click Submit.