A rate of return is a net gain or loss on an investment over a specific time period. It’s expressed as a percentage of the initial cost of the investment. There are several different methods to calculate a rate of return. For Notes investments, LendingClub uses a unique method called Net Annualized Return (NAR).

NAR is an annual rate of return where future cash flows are based on interest and any late fees from monthly borrower payments, minus service charges, charge-offs, and recoveries. You can view your NAR rate on the Account Summary page. NAR rates are updated daily.

Like any rate-of-return calculation, NAR is not a forward-looking projection of future performance. When a NAR rate is calculated, it evaluates the present value of your total Notes investment portfolio compared to your initial Notes investment. You’ll see your NAR rate after you receive your first borrower payment.

What is Net Annualized Return?

Net Annualized Return (NAR) is a measure of the rate of return, calculated annually, on principal invested over the life of a Notes investment. NAR is based on monthly borrower payments, minus service fees, charge-offs, and recoveries.

NAR is not a forward-looking projection of the performance of any Note—it’s based on actual borrower payments as they come in and actual loan charge-offs at the time a loan is charged off. NAR reflects the total principal value of a Note until the corresponding loan is charged off, even if the loan is not current.1

Since NAR measures only the rate of return on principal invested, available cash and cash committed to unissued loans are not part of the NAR calculation.

What impacts NAR?

When you start investing, your NAR approximates the interest rate of the Notes you have invested in, less any service fees. As the average age of Notes in your portfolio increases (in other words, as your existing Notes age and the percentage of your portfolio represented by new Notes decreases), your NAR will start to decrease as the loans associated with your Notes become late. When a loan is charged off, the invested principal is written off and your NAR decreases.

As a simple example, let’s say you make a one-time investment in Notes that all have an effective interest rate of 12.8% and a 36-month term. Once you subtract the 1% service fee, your approximate NAR would be 12.34%. (Note: Because of amortization, the service fee may impact NAR by more or less than 1%.)

In this scenario, you keep all of your Notes until they reach maturity and don’t make any other investments. If every borrower makes on-time payments every month of the 36-month term for their contractual monthly amount—no more, no less—then your NAR would remain at 12.34% for the entire life of the investment.

This, however, is not a realistic scenario. All investments carry risk, and NAR helps you evaluate risk based on your current Notes portfolio performance. Using the same criteria above, let’s consider a more realistic situation where late payments and charge-offs occur throughout the 36-month term.

At any given time, if a borrower doesn’t make their monthly payment, you’ll earn less interest on the principal for the Note associated with that loan, which decreases your NAR. Charge-offs have a more lasting impact and happen for many reasons: a borrower might pay off their loan early, or we may charge off the loan after it has been past due for a long time. As your loan portfolio ages, the likelihood that late payments and charge-offs will occur increases, which lowers your NAR over time.

Impact of charge-offs on Net Annualized Return*

* Chart is shown for illustrative purposes and does not represent the performance of any specific security or portfolio. It is designed to illustrate that NAR is likely to decline over time.

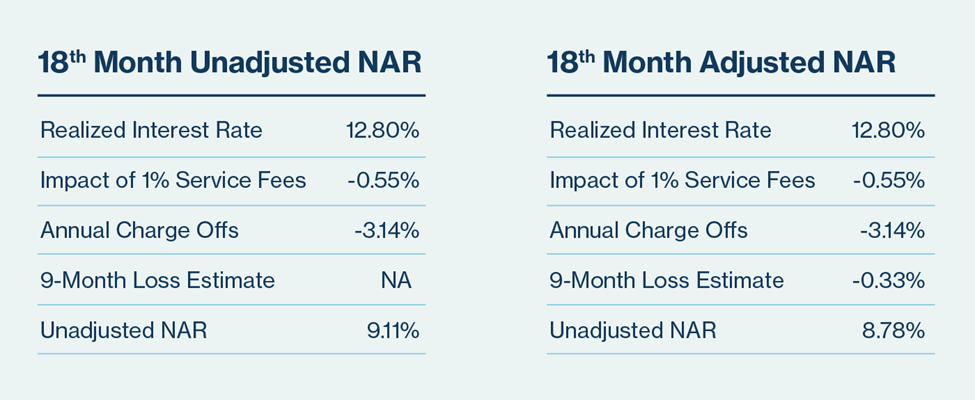

The chart above illustrates how charge-offs could impact your NAR. We start with our initial NAR rate of 12.34% (label #1). As loans are charged off, the NAR rate decreases from 12.34% to 9.11% in the 18 months following the initial investment date (#2). In the final 18 months of the portfolio, additional charge-offs reduce the NAR rate from 9.11% to 8.28% (#3). Here’s a simple calculation showing how service fees and charge-offs affect the final NAR at the end of the 36-month term:

What is Adjusted Net Annualized Return (Adjusted NAR)?

Adjusted NAR is a modified form of NAR that estimates future losses on loans that are in "past due" status but have not been charged off. If you’re familiar with net present value, Adjusted NAR functions in a similar way, but instead of projecting future cash flows, it projects future losses. You can customize the Adjusted NAR calculation to factor in your own assumptions about the future performance of your loans by signing into your Member Center and clicking View > Customize Adjustments on the Account Summary page.

To estimate future losses on loans, we apply a loss-rate estimate to the outstanding principal of loans that are past due but not charged off. The loss-rate estimate is based on the historical charge-off rate by loan status over a nine-month period.

Just like unadjusted NAR, Adjusted NAR initially approximates the interest rate of your Notes, less any service fees. As your existing Notes age, your Adjusted NAR decreases in two ways:

As loans associated with your Notes become late and enter a new tranche of days past due (for example, when they move from a status of Late 16-30 to Late 31-120)

When loans are charged off.

Adjusted NAR trends downward faster than unadjusted NAR because of the loss-rate estimate: the longer a loan is past due, the more likely it will be charged off.

Let’s look at the same scenario as above, where you make a one-time investment of loans that all have an effective interest rate of 12.8% and a 36-month term. This time, we’ll add Adjusted NAR to the mix.

Comparison of NAR and Adjusted NAR for the same portfolio†

† Chart is shown for illustrative purposes only and does not represent the performance of any specific security or portfolio. The chart assumes a hypothetical portfolio that makes a one-time purchase of Notes each with a 36-month term and 12.80% effective interest rate, holds those Notes through to their maturity, and makes no further investments. Please note that, due to amortization, the service fee may impact NAR by more or less than 1%. The chart is designed to illustrate that NAR is likely to decline over time.

In the chart above, the initial unadjusted NAR rate, less service fees, is 12.34%, just as before. The initial Adjusted NAR rate is lower, at 10.56%, because it also incorporates potential future losses (label #1).

As loans charge off, the unadjusted NAR rate decreases from 12.34% to 9.11% in the 18 months following the initial investment date. The Adjusted NAR rate decreases further, to 8.78%, due to projected future losses (#2). In the final 18 months of the portfolio, additional charge-offs cause unadjusted NAR to catch up with Adjusted NAR to meet at a final rate of 8.28% (#3). The two metrics will always result in the same rate at the end of a portfolio’s life because there are no more future losses for Adjusted NAR to project.

Here’s a simple calculation that compares NAR rates—less service fees, charge-offs, and loss estimates—between the two methods at the 18-month mark of the Notes investment:‡

‡ This example is provided for illustrative purposes only and does not represent the performance of any specific security or portfolio. Adjusted NAR and historical performance are not a guarantee of future results. LendingClub Notes are not guaranteed or insured, and investors may lose some or all of the principal invested.

How will my returns change over time?

LendingClub offers an interactive chart that illustrates how an investment is likely to perform over its lifecycle. This chart can help you understand where in the investment lifecycle your portfolio is and how its performance may change over time. Explore the various controls on the chart to visualize how average interest rates, the number of Notes, investment concentration, and other factors can influence the returns of a portfolio over time.

You can find the chart on the Understanding Your Returns page in your Member Center.