Debt Consolidation Loans

Take control of your debt

What is a debt consolidation loan?

A debt consolidation loan is a form of debt refinancing that combines multiple balances from credit cards and other high-interest loans into a single loan with a fixed rate and repayment term. It could help you save money by reducing your interest rate or making it easier to pay off debt fast with one monthly payment.

Depending on your credit profile, a debt consolidation loan could help improve your credit by diversifying your credit mix and showing that you can make on-time monthly payments.

Why consolidate your debt?

Simplify your budget

Lock in a fixed rate

Improve your credit score

Members report saving money over the course of their loan with LendingClub when they use it to consolidate debt or pay down credit cards. Debt consolidation loans from LendingClub Bank have fixed rates and terms, so your monthly payment amount never changes, plus you'll know the exact date your loan will be paid in full.

When comparing your options, remember to factor in all costs such as balance transfer fees, annual fees, and early payoff penalties you may incur with credit cards or when borrowing from other sources.

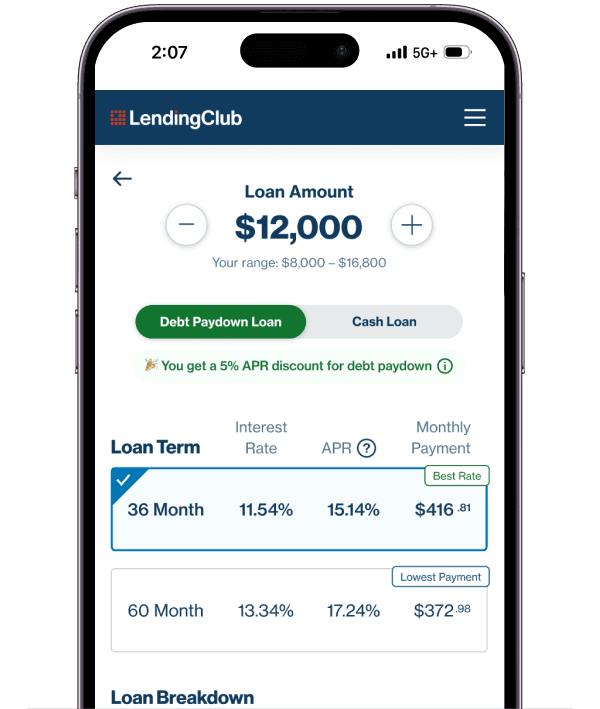

Instead of credit limits, introductory rates, or revolving balances, debt consolidation loans come with a fixed rate and an affordable monthly payment that you choose up front. This means you get to start putting a dent into your debt right away. No additional interest will be added to your loan once you lock in your rate, so nearly all of your monthly payment goes to quickly reducing your balance and paying down what you owe.

Combining multiple debt balances into one new loan is likely to raise your credit scores over the long term as long as you use the money to pay off your debt. It is possible you could see a temporary decline in your credit scores at first, but your scores can quickly recover (and improve) if you continue to make payments on time and don't accumulate any more debt.

By rolling multiple debts such as medical, credit card, or other debt balances into one loan with one monthly payment—debt consolidation can be a good idea, especially if you qualify for a lower rate. A lower interest rate will help you reduce your total debt expense and pay the debt off faster. A debt consolidation loan may also lower your monthly payment.

Checking your rate with LendingClub Bank has no impact to your credit score because we use a soft credit pull. A hard credit pull that could impact your score will only occur if you continue with your loan and your money is sent.

The good news is that a personal loan could positively impact your credit down the road if you’re able to show a history of on-time payments and a reduction in overall debt.

You can help keep things moving along by checking your To-Do List and making sure you have submitted all the documents and information requested.

Once your personal financial information is verified and your loan funded, you can choose to have the money sent straight to your bank account and/or have us pay your creditors directly. The best part is you can apply and complete the entire process online from the comfort of your home using your phone, laptop, or tablet.

With a debt consolidation loan from LendingClub Bank, you can choose to have payments automatically withdrawn from your bank account each month. We'll email you a reminder a few days in advance so you can make sure money is there. And if you prefer to mail us a check each month, that’s okay, too. You can also change your payment date, make additional payments, or pay off your loan right from your Account Summary.

What’s also great about having a debt consolidation loan with a single monthly payment and a fixed loan term, you'll know exactly how much you owe each month and can circle the day your loan will be paid off.