Emergency Loans

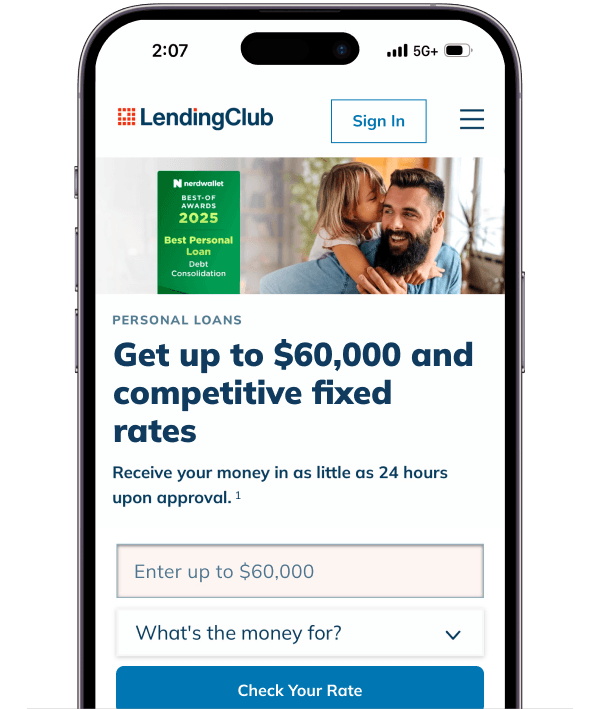

A personal loan for unexpected life events

Funding in as little as 24 hours.1

What's an emergency loan?

An emergency loan is an unsecured personal loan that can help cover unexpected expenses when you don’t have a financial cushion or can’t come up with the cash on your own right away.

While there are different forms of emergency loans (e.g., payday, auto title, or high-rate installment loans), an unsecured personal loan for emergencies is often a better option as it could offer lower interest rates, fast funding, and affordable monthly payments made over a set period.

Eligibility is based on your creditworthiness and no collateral is required.

Benefits of an emergency loan

Get funded in as little as 24 hours

Lock in a fixed rate

Protect your savings

Save money

Emergency loans often offer flexibility, allowing you to use the money to address a variety of emergency expenses, and use the funds to help pay for more than one emergency:

Home and vehicle repairs

Out-of-pocket medical expenses

Family emergencies

Unexpected expenses and bills

Housing, utilities, and food

If you’re taking out a personal loan for emergencies, you can often begin by checking your rate online with a lender who pre-qualifies you using a soft credit check. This allows you to see if you’re likely to get approved and review your loan offers without impacting your credit score.

If you select an offer and continue applying for a loan, this usually results in a “hard pull,” or inquiry on your credit report. The lender will review your application, credit history, and debt-to-income ratio and you may be asked to provide supporting documentation like a pay stub.

If you meet the qualification limits, the lender will approve your loan and provide you with a disclosure. Be sure to read everything carefully before you sign. Even in an emergency, you should know your terms, rates, and fees before you enter into a loan agreement.

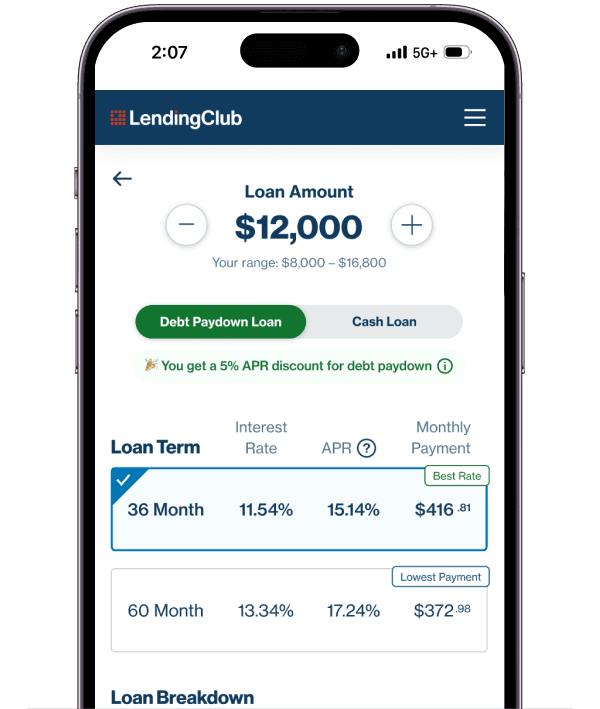

Loan amounts: Make sure the minimum and maximum loan amounts align with your needs.

Repayment terms: A longer loan term can lower your monthly payment, but a shorter term will cost you less overall.

Interest rate ranges: The lower your interest rate, the less your loan will cost.

Eligibility requirements: Loan approval usually is based on your credit score, payment history, and income, among other factors.

Fees: Application costs, origination fees, and prepayment penalties vary by lender and may impact your total cost. Compare APRs across a couple of different lenders to understand the true cost of each loan offer.

Joint applications: If you think you might not qualify based on your credit history, work with a lender that accepts co-borrowers and apply together for a joint personal loan.

Personal Loans vs. Credit Card Comparison

Personal Loans

- Installment loans can help you pay down debt and take control of your budget

- Single, fixed rate monthly payment is easy to manage

- Fixed monthly payment and payoff date saves you money over time

- Lower average APRs compared to credit cards3

Credit Cards

- Revolving credit accounts can lead to overspending

- Managing multiple credit cards with variable due dates, limits, and terms is time consuming and stressful

- Low minimum monthly payments and revolving compound interest can trap you in a cycle of debt

- Higher average APRs are an expensive way to pay for large purchases

Banks, credit unions, and online lending marketplaces, and other lenders may offer emergency loans. Generally, be wary of high-interest loans or lenders that only promise fast funding, especially without a credit check. A reputable online lender that lets you check your rate without it impacting your credit score is a good option.

Some lenders let you check your loan offers with a soft credit check, the type that doesn’t impact your credit scores. If you decide to apply for a loan after reviewing your offers, you will need to agree to a hard credit check, which may or may not affect your scores, depending on your credit profile.

You can use a personal loan for emergency expenses and bills. Typical uses include home repairs, fixing a broken-down vehicle, medical bills, and household expenses. LendingClub Bank doesn’t offer loans for expenses related to education after high school, making investments (including buying cryptocurrencies), or anything illegal.

You can get an emergency loan even if you have bad credit, but you may have fewer options and wind up paying more in interest and fees. In some cases, using a credit card or asking your creditors for a hardship plan may be better than taking out a payday loan or high-rate emergency loan.

Lenders may have minimum and maximum emergency loan amounts. LendingClub Bank offers unsecured personal loans for up to $60,000. The minimum starts at $1,000, but minimum amounts can vary based on state laws.

Our process makes it easy for you to check your rate and apply in minutes. To avoid delays, you can check your to-do list and quickly submit all the required documents and information. Once your loan is approved for funding, we’ll pay your creditors directly or send the money in as little as 24 hours.