WEDDING LOANS

Use a personal loan to finance your wedding

What is a wedding loan?

A wedding loan is a personal loan you can use to help pay for your wedding, honeymoon, and related expenses. Securing wedding financing early in the planning process can help reduce stress and allow you to deal with unexpected deposit requests or emergencies.

A loan with a fixed rate can get you the money you need and set you up with predictable monthly payments and an agreed-upon end date for repayment.

Why get a wedding loan?

Cover all costs

Lock in a fixed rate

Peace of mind

Wedding loans can be used for any expenses related to your wedding, including your engagement and honeymoon.

Engagement parties

Rehearsal dinners

Deposits

Venues and vendors

Wedding rings

Attire

Air travel and hotels

Unexpected expenses

A personal loan for wedding expenses can be a relatively easy and flexible option. Typically, you can check your loan offers without any obligation or impact on your credit scores. After your loan is approved, funds are deposited directly into your bank account, and you can spend the money as needed. You’ll then repay the loan in fixed monthly installments for the repayment term.

Many lenders offer personal loans that can be used for wedding expenses. When deciding which lender is right for you, you’ll want to compare:

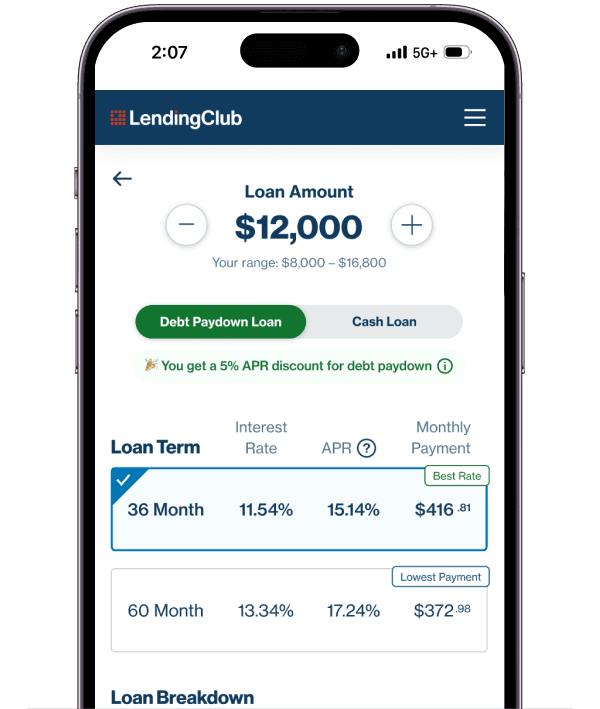

Loan amounts: Make sure the minimum and maximum loan amounts align with your needs.

Repayment terms: A longer loan term can lower your monthly payment, but a shorter term will cost you less overall.

Interest rate ranges: The lower your interest rate, the less your loan will cost overall.

Eligibility requirements: Loan approval usually is based on your credit score, payment history, and income, among other factors.

Fees: Application costs, origination fees, and prepayment penalties vary by lender and may impact your total cost. Compare APR’s across a couple of different lenders to understand the true cost of each loan offer.

Joint applications: If you think you might not qualify on your own based on your credit history, work with a lender that accepts co-borrowers and apply together for a joint personal loan.

Personal loans vs. Credit cards

Personal loans

- Installment loans can help you pay down debt and take control of your budget

- Single, fixed rate monthly payment is easy to manage

- Fixed monthly payment and payoff date saves you money over time

- Lower average APRs compared to credit cards2

Credit cards

- Revolving credit accounts can lead to overspending

- Managing multiple credit cards with variable due dates, limits, and terms is time consuming and stressful

- Low minimum monthly payments and revolving compound interest can trap you in a cycle of debt

- Higher average APRs are an expensive way to pay for large purchases

Wedding loans are unsecured (no collateral required) loans, which means your debt-to-income ratio and credit and payment history all play a big part in determining if you qualify, the amount you can borrow, interest rate, and loan terms.

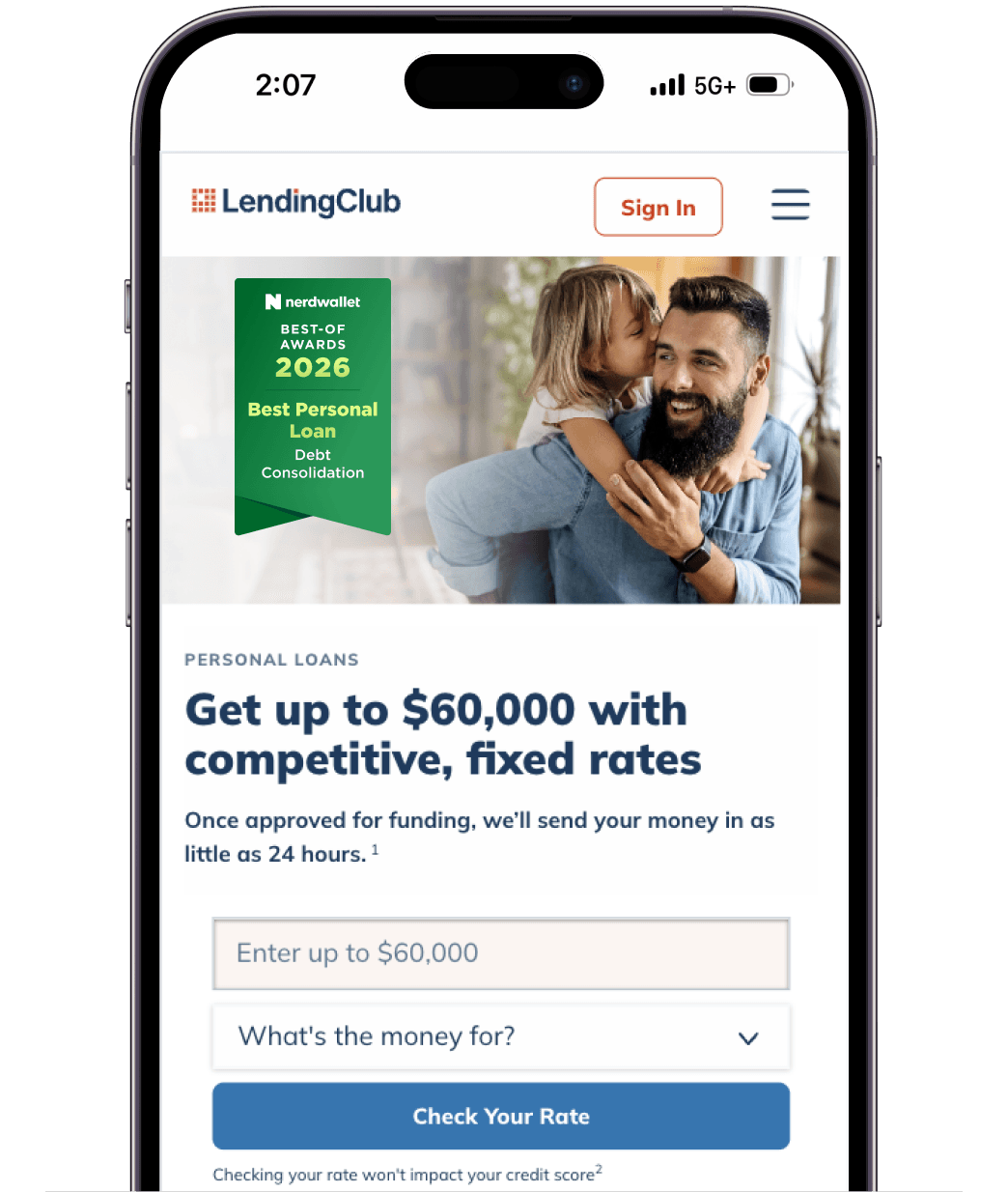

With LendingClub, you can check your rate and see loan offers without it impacting your credit score.

Many online lenders offer unsecured personal loans you can use to pay for your wedding—and almost any other expense. Some banks and credit unions also offer unsecured personal loans, though many require you to have an account already established with them before you can apply. The best lenders let you check your rate with a soft credit inquiry, which won’t impact your credit score, and offer loans with low fees and interest rates that are repaid over a predetermined length of time.

You may be able to get a wedding loan if you have poor credit. However, your credit history and overall creditworthiness are important factors in determining both your eligibility and the interest rate you’ll receive.

Improving your credit first or submitting a joint application with someone who has better credit can improve your chances of getting a larger loan offer with a more favorable rate.

The average budget for couples on their wedding is over $20,000, not including the cost of an engagement ring or honeymoon. And wedding costs vary depending on where you live and the type of wedding you want. Create a wedding budget that aligns with your vision for the big day, and then decide if you need a loan for wedding expenses.

Using a personal loan for wedding financing could be less expensive than using a credit card, especially if you’re unable to pay the balance off in full within a couple of months. But it depends on your loan’s fees, interest rate, and repayment terms. Keep in mind some wedding vendors will charge a fee if you pay with a credit card or won’t accept them at all. At LendingClub, you can check your rate for free without impacting your credit score, so you can more easily compare your options before making a decision.

You can help keep things moving along by checking your To-Do list and making sure you have submitted all the documents and information requested.