LevelUp Checking

Earn over $200 in cash back rewards a year!

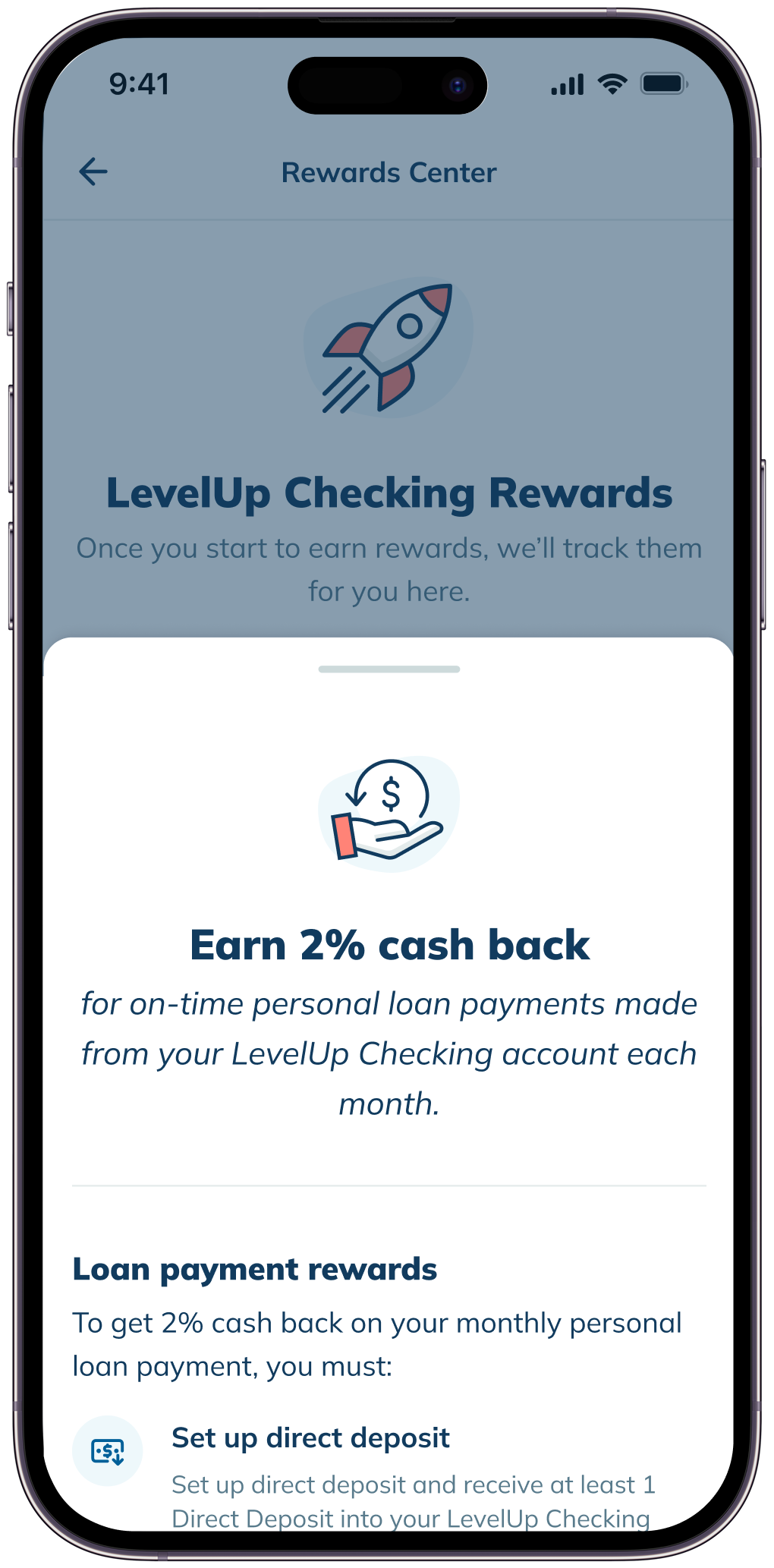

You can earn 2% cash back for on-time personal loan payments and 1% cash back on debit card purchases.1,2

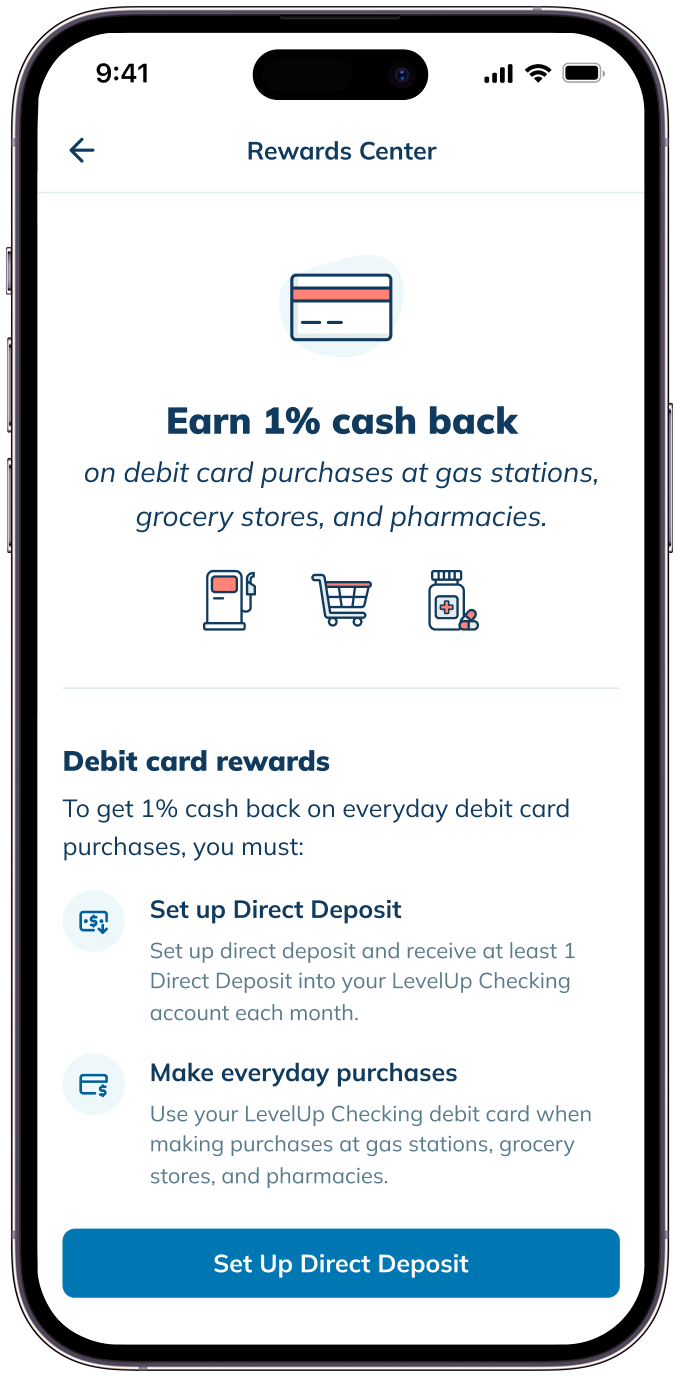

Earn 1% cash back on purchases when you use your debit card at gas stations, grocery stores, and pharmacies.²

Already have a LendingClub personal loan? You'll earn 2% cash back for on-time payments from your LevelUp Checking account.¹

You could get your paycheck up to 2 days early, giving you faster access to the money you need.4

Unlock all these benefits with a Direct Deposit into your account each month.

Earn more than $200 per year in cash back rewards⁵

With LevelUp Checking, members see their rewards add up to over $200 a year!

Want even more perks? You got it!

1.00% APY

$0 fees

Unlimited ATM fee rebates

Stack your products. Stack your benefits.

Boost your earnings with LevelUp Savings

Earn 4.00% APY with LevelUp Savings when you deposit $250+ per month.⁸

Track your rewards in the LendingClub app

Check how many rewards you’ve earned so far in your personalized rewards-earnings center.

Get free credit monitoring with DebtIQ™

Activate DebtIQ in the LendingClub app to stay on top of your credit score and report.

Open a reward-earning

LevelUp Checking account today

$0 fees. $0 minimum balance. Unlimited cash back.1,2

Your reward-earning gets better in the app

Make the smartest money move of the day.

Download the LendingClub app now.⁹

To get 2% cash back on your monthly LendingClub personal loan payment, follow these requirements:

Set up Direct Deposit: Set up Direct Deposit and receive at least 1 Direct Deposit into your LevelUp Checking account each month.

Pay your LendingClub personal loan on time: Pay the monthly payment amount on your LendingClub personal loan on time and from your LevelUp Checking account.

See Terms & Conditions for additional details.

To get 1% cash back on qualified Purchases, follow these requirements:

Set up Direct Deposit: Set up Direct Deposit and receive at least 1 Direct Deposit into your LevelUp Checking account each month.

Make qualified purchases: Simply use your LevelUp Checking debit card for purchases at qualifying gas stations, grocery stores, and pharmacies.

There are no fees for your account.

LendingClub doesn't charge a fee to use another bank’s ATM. LendingClub is centered around empowering you to meet your financial goals and will reimburse you for ATM fees charged by other banks and ATM owners. Your reimbursements will appear in your LevelUp Checking accounts, when they’re posted to your account at the end of each statement cycle.

Any earned rewards for your account will be posted the following month in the Rewards Center within the LendingClub app and online banking.

Security

FDIC Insurance

Customer support

Chat with us online, or reach us by phone or email.