Home Improvement Loans

Finance your home renovation project

What is a home improvement loan?

A home improvement personal loan is an unsecured (no collateral) fixed-rate personal loan that is used for home renovations and repairs and repaid over a set length of time. Home improvement personal loans are a smart alternative to revolving high-interest credit cards and faster than tapping into home equity.

Instead of waiting for your house, condo, or apartment to accumulate enough equity for a cash-out refi or home equity line of credit, you could get a personal loan for home upgrades in as little as a few days—no collateral, appraisal, or costly refinancing required.

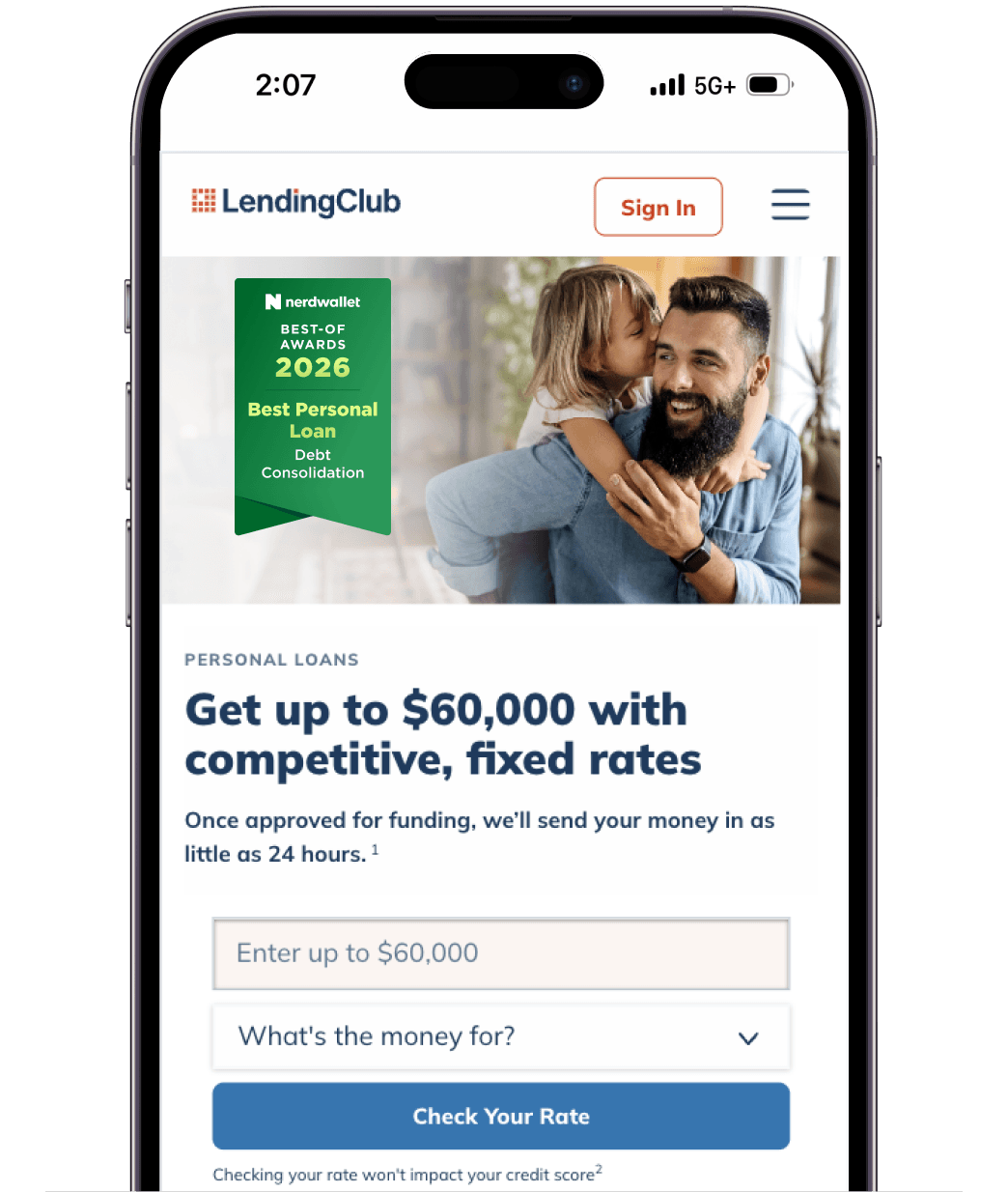

Join over 5 million members

Borrow up to $60,000

Quick and easy online application

Eligibility is based on credit history, not home value

Funding in as little as 24 hours.

No prepayment fees

Make upgrades and repairs faster and easier than refinancing

Expand your living space

Cover urgent repairs

Improve energy efficiency

A home improvement personal loan is an easy-to-access, unsecured (no collateral required) fixed-rate loan repaid over a set period of time for home renovations and repairs. Home improvement personal loans are a smart alternative to revolving high-interest-rate credit cards and faster than tapping into home equity.

With a home improvement personal loan you can upgrade or make repairs more quickly, without wading through a lot of paperwork, or wait for a home appraisal and a long approval process.

While you will have an origination fee on a personal loan with LendingClub, there are no application fees, prepayment penalties, or unreasonable refinancing closing costs to worry about. Since personal loans require no collateral to back the loan (except for your good credit), you will likely receive a lower interest rate with a home equity loan, however, you risk losing your home to foreclosure if you’re unable to make your home equity loan payments.

Because eligibility is based on your creditworthiness (not on the fluctuating value of your home), getting a personal loan requires less time, less hassle, no home appraisal, and less paperwork than refinancing. And you get to decide exactly how the money will be used—even if it's for more than home upgrades (like paying off credit cards). Plus, your rate and monthly payments are fixed (not variable) over a set length of time, so you'll know exactly when your loan will be paid in full.

Checking your rate takes only minutes and won't impact your credit score. After checking your rate, here's what's next:

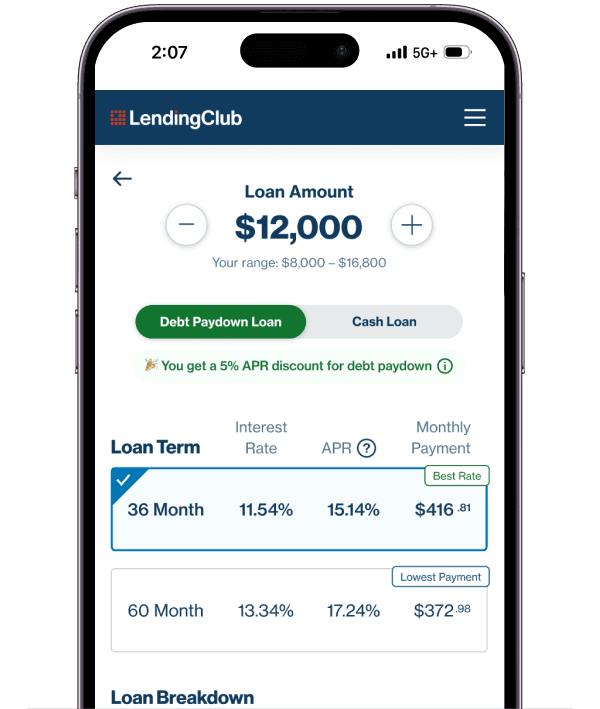

Choose your offer

If your loan request is approved, you’ll be able to review the loan amount, interest rate, APR, monthly payment, and loan term.

Confirm your information

We ask for your Social Security number, and about your income and employment. If we need any other documents or information, we'll let you know in your To-Do List. Then, hold tight while we finalize your application.

Get funded

Once your loan is approved, we’ll send the money directly to your bank account.

Instead of worrying about credit limits, introductory rates, or high-interest-rate revolving balances, a personal loan offers a competitive rate and fixed monthly payment repaid over a set length of time. This means you’ll know the exact date your loan will be paid in full.

No additional interest will be added to your loan once you lock in your rate, so nearly all of your monthly payment goes to quickly reducing your balance and paying down what you owe.

Checking your rate with LendingClub has absolutely no impact on your credit score because we use a soft credit pull. A hard credit pull that could impact your score occurs only if you continue with your application and a loan is issued to you.

Also remember that a personal loan could have a positive impact on your credit in the future if you’re able to show a history of on-time payments and a reduction in overall debt (not taking on new debt, such as higher credit card balances).

We make it easy so you can check your rate in minutes! You can help keep things moving along by checking your To-Do List and making sure you have submitted all the documents and information requested.

Applying is easy and the entire process can be completed online using your phone, laptop, or tablet.

With a personal loan for home improvements from LendingClub, you can choose to have payments automatically withdrawn from your bank account each month. We'll email you a reminder a few days in advance so you can make sure the money is there.

If you prefer mailing us a check each month instead, that’s okay, too. You can also change your payment date, make additional payments, or pay off your loan right from your Account Summary.