Moving Loans

Make your move with a personal loan

What is a moving loan?

Moving loans, or relocation loans, are unsecured personal loans that help cover the cost of moving your household. Especially if you find yourself in a hurry to move, a personal loan for moving offers fixed rates, predictable monthly payments, flexibility on how and when you can use the money, and, best of all, fast funding if approved.

Along with covering costs like moving services, truck rentals, and hotel stays, relocation loans are a convenient way to pay for some or all other related expenses that come with moving, such as security deposits, new furniture, and home repairs.

Why get a moving loan?

Cover all costs

Lock in a fixed rate

Peace of mind

Personal loans vs. Credit cards

Personal loans

- Installment loans can help you pay down debt and take control of your budget

- Single, fixed rate monthly payment is easy to manage

- Fixed monthly payment and payoff date saves you money over time

- Lower average APRs compared to credit cards2

Credit cards

- Revolving credit accounts can lead to overspending

- Managing multiple credit cards with variable due dates, limits, and terms is time consuming and stressful

- Low minimum monthly payments and revolving compound interest can trap you in a cycle of debt

- Higher average APRs are an expensive way to pay for large purchases

Because most relocation loans are unsecured, your eligibility and offers depend on your creditworthiness, income, and current debt. A good or excellent credit score, steady income, and a good debt-to-income ratio can improve your chance of securing a loan with a low-interest rate and the amount you need.

Once you receive and accept your loan offer, you can use your loan to hire movers, rent a moving truck, pay a security deposit, furnish your new home, cover other moving and living expenses, and more.

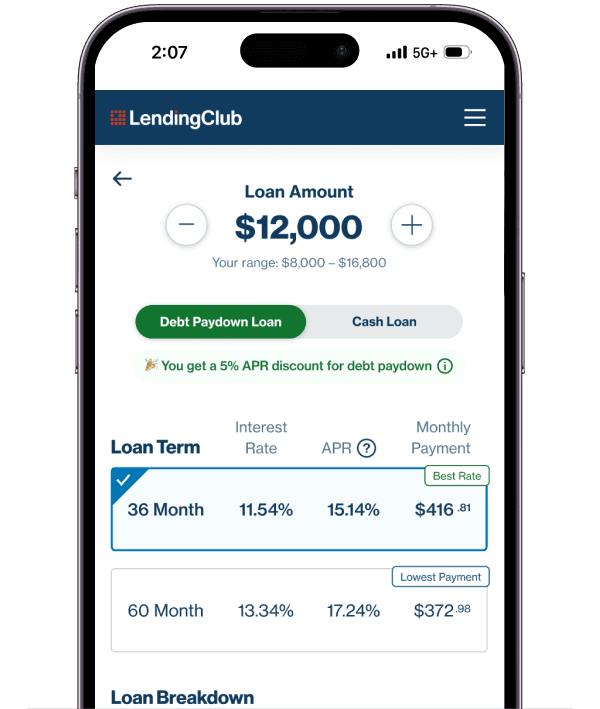

At LendingClub, you can precheck your rate without hurting your credit. You then review the loan terms, pick an offer, complete the application, accept the official offer, and funds are deposited directly into your bank account. Once you get the loan, you’ll repay it with fixed monthly payments over a set period of time.

There are moving loans for bad credit borrowers, but you may find the fees and high-interest rates make them a poor option. If possible, try to boost your credit score before applying, or consider taking out a joint loan or using a co-borrower with better creditworthiness. In some cases, using a credit card could be less expensive.

You might also consider cutting costs by renting a truck and asking friends or family to help with your move rather than hiring a moving service.

You can help keep things moving along by checking your to-do list and making sure you have submitted all the documents and information requested.

Moving costs vary depending on where you live, how far you’re moving, and how much stuff you need to move. You can often save money by doing the move yourself rather than hiring movers, though that generally takes more time and planning, and can be very stressful. And keep in mind long-distance relocations are almost always more expensive than a local move, even if you go the DIY route.